British Pound Technical Forecast: GBP/USD Weekly Trade Levels

- GBP/USD testing resistance with the immediate focus on a breakout of this week’s range as the Fed decision approaches.

- A break of this zone would be needed to validate a push toward larger resistance objectives, while failure here risks preserving the broader June downtrend.

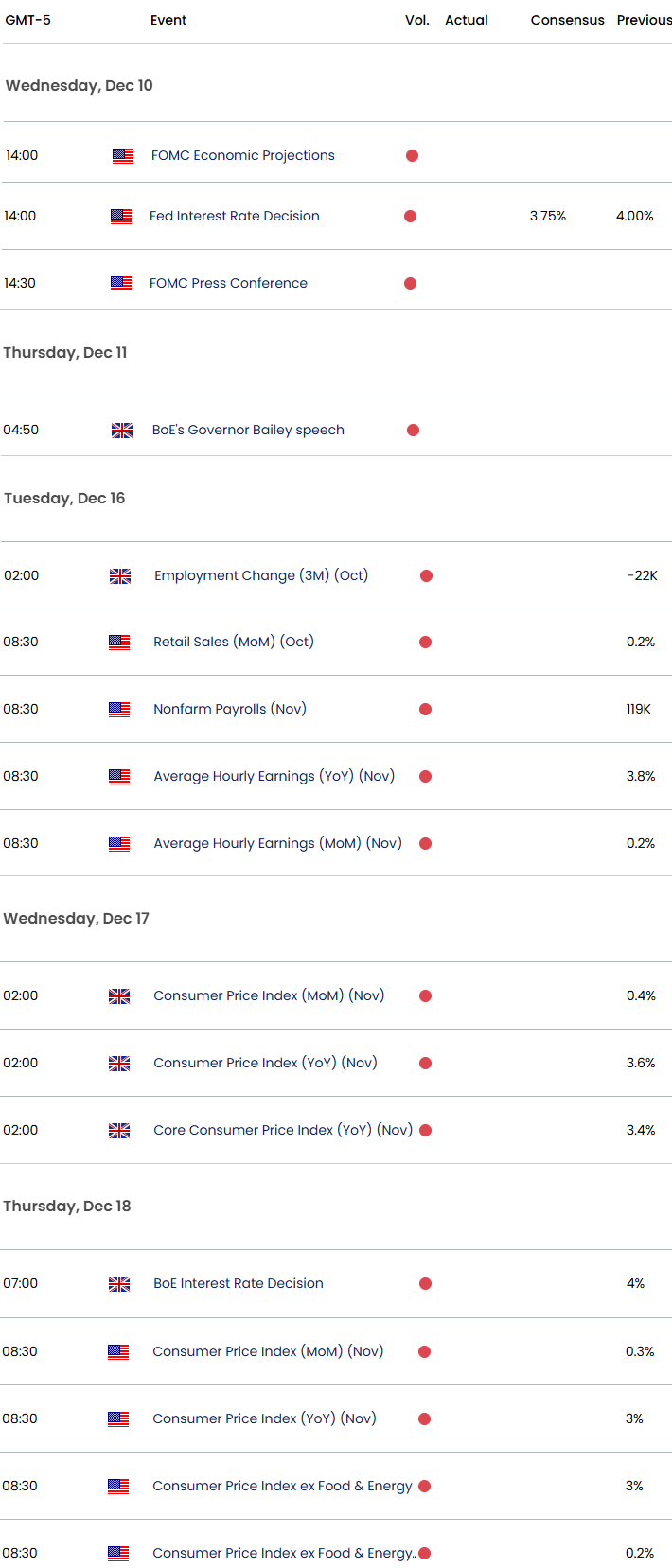

- Economic docket remains heavy next week with NFPs, CPI and the BoE rate decision on tap

- Resistance 1.3372, 1.3453/69 (key), 1.3648- Support 1.3280, 1.3148/54 (key), 1.3080/92

The British Pound is threatening to snap a two-week rally with GBP/USD trading just below downtrend resistance ahead of today’s highly anticipated Fed rate decision. The setup leaves the pair vulnerable to a near-term inflection, with the broader June downtrend remaining intact while below resistance. A breakout here would be needed to clear the path for a larger advance, while failure risks shifting the focus back toward the 52-week moving average. The attention now shifts to the updated Summary of Economic Projections as traders gage the outlook for monetary policy next year. Major event risk extends into next week with key data on tap alongside the Bank of England rate decision. Its decision time for the Sterling bulls and the battle lines are drawn on the GBP/USD weekly technical chart.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Sterling setup and more. Join live on Monday’s at 8:30am EST.

British Pound Price Chart – GBP/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

Technical Outlook: In last month’s British Pound Weekly Forecast we noted that GBP/USD was, “testing support this week and although the broader outlook remains tilted to the downside the immediate focus is on possible inflection off this zone with short-bias vulnerable while above.” The level in focus was 1.3080/92- a region defined by the 100%extesniuon of the June decline and the 2023 high-week close (HWC). Sterling attempted to break this key zone for more than four-weeks before rebounding into the close of the month with the rally extending nearly 2.9% off the November low.

The bulls exhausted into confluent resistance last week at the 2024 HWC at 1.3377- note that the 75% parallel of the descending pitchfork converges on this threshold this week and a breach / weekly close above would be needed to fuel the next leg of this advance towards key resistance at the 61.8% retracement / September HWC at 1.3453/69. Look for a larger reaction there IF reached- strength surpassing this level would suggest a more significant trend reversal is underway with the next major technical consideration eyed at the 2025 HWC at 1.3648.

Initial weekly support now rests with the July low-week close (LWC) at 1.3280 and is backed by a key confluent zone at 1.3149/54. This region is defined by the 61.8% retracement of the November advance, the 52-week moving average, and the median-line. Ultimately a close below the 1.3080 would be needed to mark resumption of the broader June downtrend with subsequent support objectives seen at the March high-week close and the 2024 March high at 1.2894/95.

Bottom line: Sterling is testing resistance this week- risk for inflection off this mark as we head into the Fed rate decision later today. From a trading standpoint, the immediate focus is on a breakout of the 1.3280-1.3372 range for guidance- ultimately, rallies would need to be limited to 1.3469 for the June downtrend to remain viable with a break below the 52-week moving average needed to fuel the next leg of the decline.

Keep in mind the economic docket is loaded next week with November Non-Farm Payrolls and the Consumer Price Index (CPI) on tap out of the US. UK CPI is slated for Wednesday with the Bank of England on Thursday- the committee remains divided on the path for interest rates after the 5-4 vote to hold last month, and the release has the potential to fuel substantial Sterling volatility next week. Stay nimble into these releases and watch the weekly closes here for guidance. Review my latest British Pound Short-term Outlook for a closer look at the near-term GBP/USD technical trade levels.

GBP/USD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- US Dollar Index (DXY)

- Euro (EUR/USD)

- Canadian Dollar (USD/CAD)

- Swiss Franc (USD/CHF)

- Japanese Yen (USD/JPY)

- Australian Dollar (AUD/USD)

- Crude Oil (WTI)

- S&P 500, Nasdaq, Dow

- Bitcoin (BTC/USD)

- Gold (XAU/USD)

--- Written by Michael Boutros, Senior Technical Strategist

Follow Michael on X @MBForex