The Commodity Channel Index (CCI) is a versatile momentum-based technical analysis indicator developed by Donald Lambert in 1980. It is primarily used to identify cyclical trends in commodities, but it can also be applied to stocks, forex, and other financial instruments. The CCI measures the deviation of the price from its average over a specified period, allowing traders to identify overbought and oversold conditions.

Key Features:

Formula:

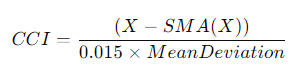

The CCI is calculated using the following formula:

- X: Typical price, calculated as ((High + Low + Close) / 3).

- SMA(X): Simple Moving Average of the typical price over a defined period.

- Mean Deviation: The average deviation of the typical price from the SMA.

Range:

- The CCI oscillates above and below zero and typically ranges from -100 to +100, although it can exceed these levels during strong trends.

- Above +100: Indicates overbought conditions, suggesting a potential reversal or correction to the downside.

- Below -100: Indicates oversold conditions, suggesting a potential reversal or rally to the upside.

Interpretation:

- Overbought Conditions: When the CCI rises above +100, it signals that the asset may be overbought, and traders might look for selling opportunities.

- Oversold Conditions: When the CCI falls below -100, it indicates that the asset may be oversold, and traders might consider buying opportunities.

- Divergence: Traders also look for divergences between the CCI and price movements. For example, if the price is making new highs while the CCI is failing to reach new highs, it may suggest weakening momentum and a potential reversal.

Usage in Trading:

- Trend Identification: The CCI can help identify the strength and direction of a trend. A sustained CCI above zero suggests an uptrend, while a sustained CCI below zero suggests a downtrend.

- Entry and Exit Signals: Traders often use the CCI to time entry and exit points. A crossover above +100 can be a signal to sell, while a crossover below -100 can be a signal to buy.

- Combining with Other Indicators: The CCI is frequently used in conjunction with other technical indicators, such as moving averages, to enhance trading strategies and confirm signals.

Advantages:

- Versatility: The CCI can be applied to various markets and timeframes, making it a flexible tool for different trading strategies.

- Early Warning of Reversals: The CCI can provide early signals of potential reversals, allowing traders to position themselves ahead of price changes.

Limitations:

- False Signals: Like many momentum indicators, the CCI can generate false signals, especially during choppy or sideways markets.

- Lagging Indicator: The CCI may lag behind price action, leading to delayed signals during fast-moving markets.

Conclusion:

The Commodity Channel Index (CCI) is a powerful tool for identifying overbought and oversold conditions, potential reversals, and the strength of trends. Its ability to adapt to various markets and timeframes makes it a popular choice among traders. However, it is essential to use the CCI in conjunction with other technical analysis tools to enhance accuracy and reduce the risk of false signals.